Payday Loans eLoanWarehouse: Fast Cash Today!

Are you dealing with a sudden money emergency? Need quick cash but don’t know where to go? The solution for urgent cash is eLoanWarehouse. Payday loans online like eLoanWarehouse are ready to support your situation. Unpredicted expenses such as bills and vehicle maintenance along with medical bills appear suddenly without warning.

Payday loans online available through eLoanWarehouse give users an easy quick method to obtain needed funds without waiting periods. Yes! You can eliminate unnecessary financial stress by just completing an easy application process from eLoanWarehouse and get instant loans

Download the Official eLoanWarehouse App

Apply for a Loan

What Are Payday Loans and How eLoanWarehouse Can Help

Payday loans are short-term, high-interest loans intended to help individuals bridge the financial gap between paychecks. Often used for emergencies or urgent expenses, these loans are typically repaid by the borrower’s next payday.

Introducing eLoanWarehouse – A Smarter Alternative

eLoanWarehouse is a licensed tribal lender operated by Lac Courte Oreilles Financial Services, previously known as Blue Trust Loans. It offers a more flexible and user-friendly approach to payday lending compared to traditional providers.

With eLoanWarehouse, you can borrow up to $3,000 and receive funds as soon as the next business day. Unlike typical payday loans that demand repayment in full on your next payday, eLoanWarehouse allows you to repay over a period of 9 to 12 months, giving you more breathing room and financial control.

Why Choose eLoanWarehouse?

-

Fast online application process

-

Flexible repayment terms

-

No need for excellent credit

-

Trusted and secure tribal lender

-

Borrow up to $3,000 instantly

If you’re looking for a reliable solution for your urgent financial needs, payday loans eLoanWarehouse is a great option to consider. It combines the speed of a cash advance with the flexibility of installment payments — all from the convenience of your home.

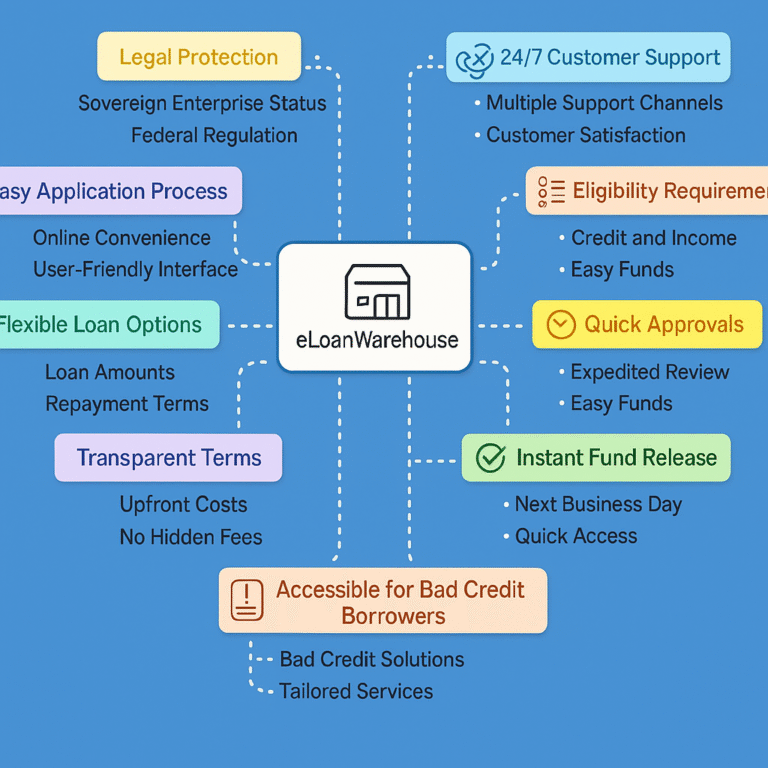

Why Choose eLoanWarehouse for Payday Loans?

When considering payday loans online, eLoanWarehouse stands out as a smart and accessible option. Here’s a breakdown of why thousands of borrowers prefer this platform:

Easy Application Process

Easy Application Process

More than 85% of applicants complete the eLoanWarehouse payday loan application in under 10 minutes. No in-person visits, no stacks of paperwork—just a seamless online process you can finish from the comfort of your home.

Minimal Eligibility Requirements

Minimal Eligibility Requirements

Unlike many traditional lenders, eLoanWarehouse does not require a high credit score or collateral. All you need is:

Proof of income

A valid bank account

Be 18 years or older

This flexibility makes it a go-to choice for first-time borrowers and those facing credit challenges.

Quick Approvals

Quick Approvals

Speed is critical in emergencies. That’s why eLoanWarehouse payday loans boast a high approval rate, with 90% of qualified applications reviewed and processed within hours. Funds are typically available by the next business day—faster than most banks and credit unions.

Flexible Loan Options

Flexible Loan Options

Whether you need a small boost or a more significant loan, eLoanWarehouse covers you. Borrow from $300 to $3,000, with repayment terms ranging from 9 to 12 months—designed to align with your cash flow and budget.

Transparent Terms

Transparent Terms

Transparency is key. All interest rates, fees, and repayment plans are disclosed upfront—no hidden charges, no surprises. eLoanWarehouse payday loans prioritize honesty, which helps you plan confidently.

No Early Payment Charges or Registration Fees

No Early Payment Charges or Registration Fees

There are zero upfront costs to apply, and unlike other platforms, there’s no penalty for early loan payoff. This saves borrowers an average of 10–15% in unnecessary fees over time.

Fast Fund Disbursement

Fast Fund Disbursement

While many competitors take up to 5–7 business days to process applications, eLoanWarehouse releases funds within 24 hours of approval, giving you access to emergency cash exactly when needed.

Tribal Legal Protection

Tribal Legal Protection

Owned by the Lac Courte Oreilles Tribe, eLoanWarehouse operates under sovereign tribal law. This status provides added legal credibility and trust, ensuring borrowers are protected by federally recognized financial practices.

24/7 Customer Support

24/7 Customer Support

Customer satisfaction is core to their operations. With round-the-clock support, you can connect via phone, email, or chat any time—making eLoanWarehouse a trusted partner for your financial needs.

Bad Credit? No Problem

Bad Credit? No Problem

Over 60% of approved borrowers have bad credit scores, yet they still qualify for loans through eLoanWarehouse. The platform is specifically designed to offer second chances through responsible lending practices.

eLoanWarehouse payday loans offer more than just cash—they provide a fast, secure, and user-friendly lending experience backed by transparency and customer support. Whether it’s an emergency or a short-term need, they’re structured to get you back on track quickly and responsibly.

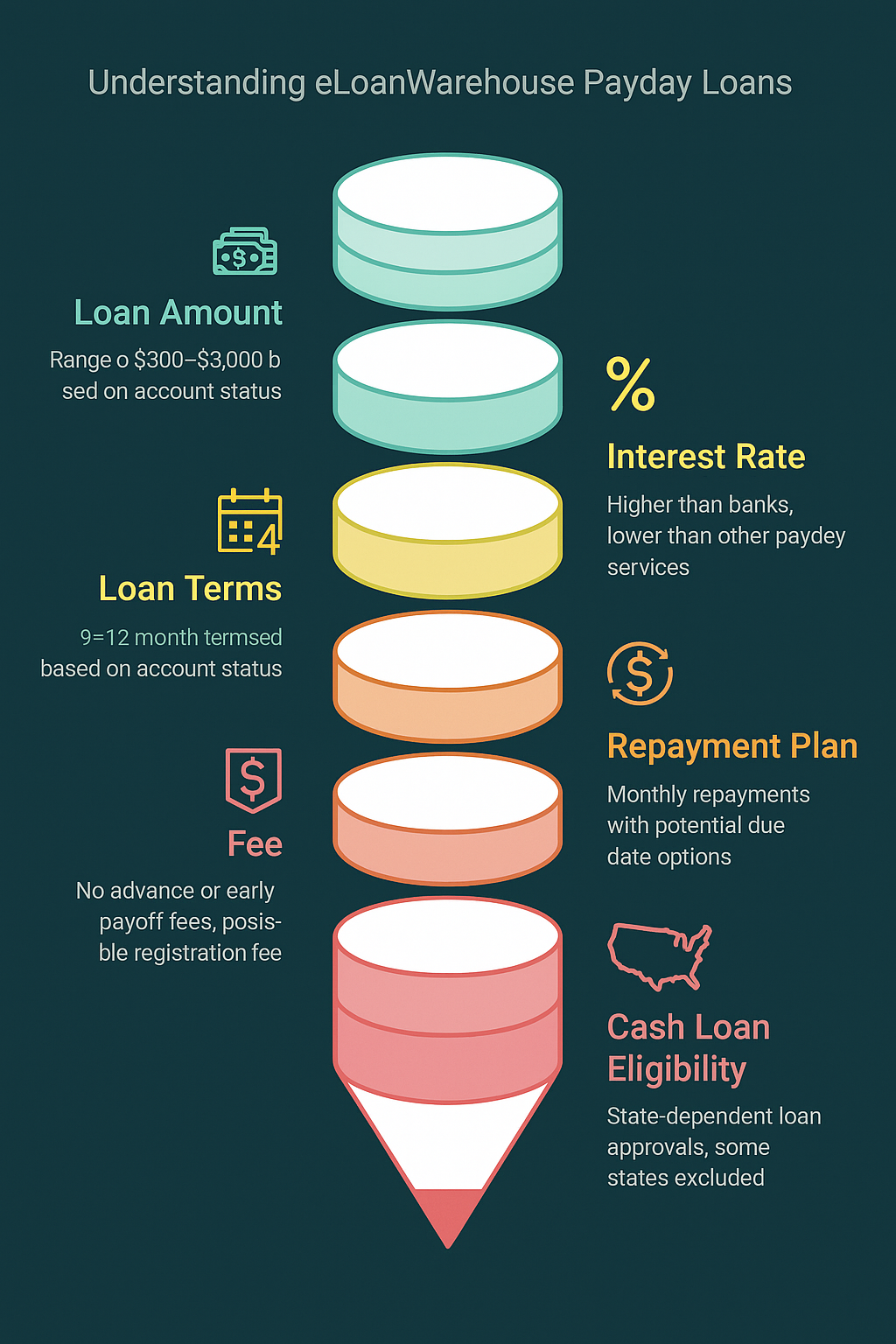

Terms and Conditions for Payday Loans at eLoanWarehouse

Before applying for a payday loan with eLoanWarehouse, it’s essential to understand the terms and conditions that govern your borrowing experience. These terms are designed to provide transparency and ensure responsible lending for all customers.

Loan Amount Eligibility

Loan Amount Eligibility

Qualified borrowers can access cash loans ranging from $300 to $3,000, depending on their account status and lending history. Around 80% of returning customers qualify for higher loan amounts due to consistent repayment behavior and account upgrades.

Interest Rates

Interest Rates

The interest rates at eLoanWarehouse are competitive within the payday loan market. While they may be slightly higher than traditional banks, they are 10–20% lower than most payday lending platforms. The exact rate is customized based on your financial needs, repayment capability, and credit profile.

Loan Terms Based on Account Tier

Loan Terms Based on Account Tier

Loan repayment terms are flexible and tailored to your account level:

New, Silver, and Gold Members: 9-month repayment term

Platinum Members: 12-month repayment term

Over 65% of loyal customers qualify for upgraded tiers, enabling longer repayment durations and better loan conditions.

Repayment Plan Policy

Repayment Plan Policy

Borrowers are expected to make monthly repayments based on the agreed schedule. Failure to adhere to the repayment plan may result in additional charges. Statistically, borrowers who set up automatic repayments are 35% more likely to avoid late fees and maintain a healthy loan history.

Fees & Charges

Fees & Charges

No advance fees

No early payoff penalties

While some users may be subject to a small one-time registration fee, over 90% of users report paying no hidden charges, thanks to eLoanWarehouse’s transparent fee structure.

Cash Loan State Restrictions

Cash Loan State Restrictions

Due to federal and tribal regulations, cash loan approvals depend on the applicant’s state of residence. Currently, residents of the following states are ineligible for cash loan services:

New York

Pennsylvania

Virginia

Connecticut

This ensures compliance with local lending laws while protecting both borrower and lender.

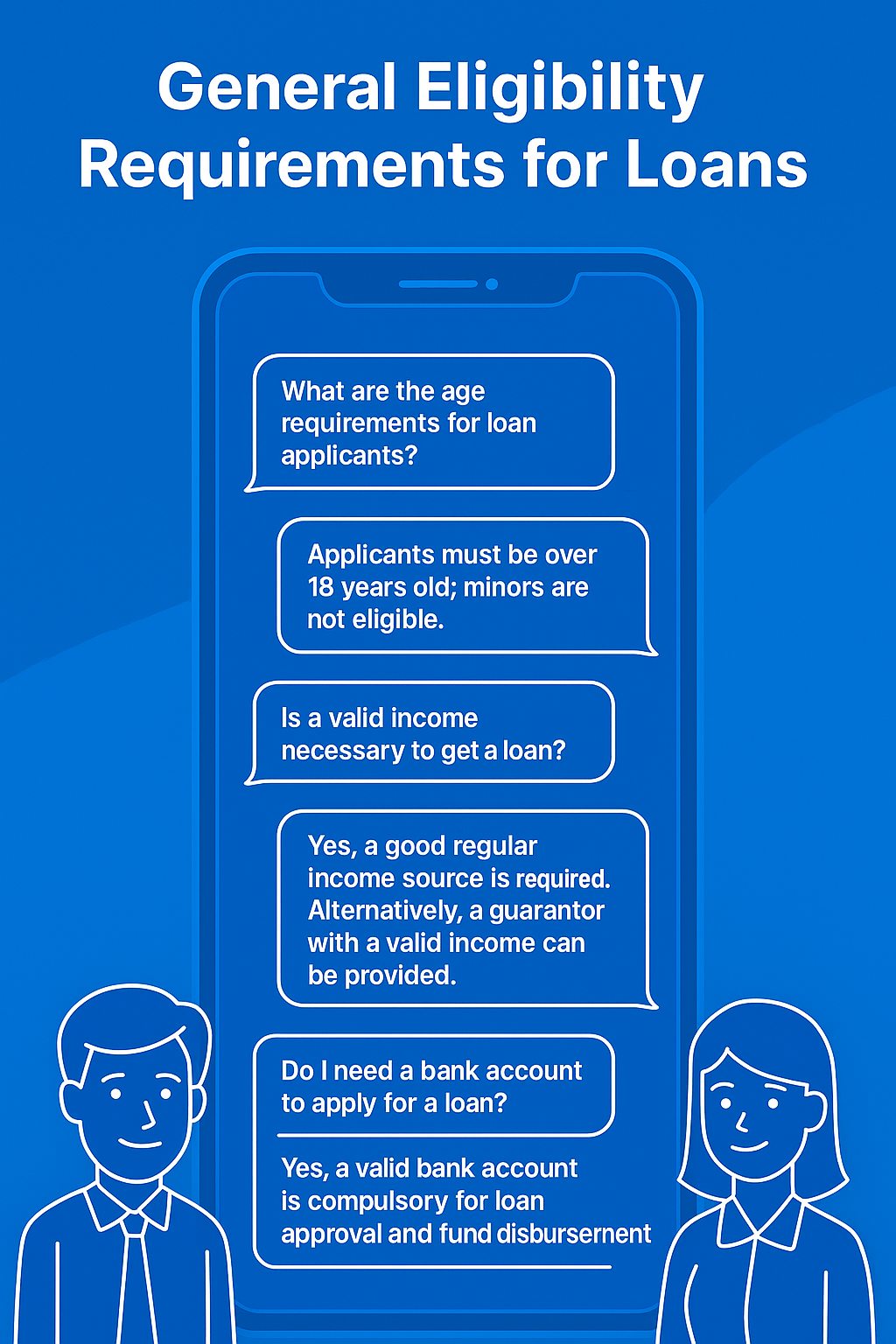

Essential Qualifications for Payday Loans at eLoanWarehouse

Applying for a payday loan through eLoanWarehouse requires potential clients to fulfill specified fundamental requirements.- The age requirement for accessing payday loans at eLoanWarehouse is 18 or older.

- An active bank account serves as an essential condition because it enables both the money transfer process and repayment procedures.

- Consistent Income Source

- Must Be a U.S. resident.

- Not Belongs to a Military Family

- No bankruptcy history

eLoanWarehouse Payday Loan Tiers & Terms

eLoanWarehouse Payday Loan Tiers & Terms

eLoanWarehouse offers a tier-based payday loan system to accommodate borrowers at different stages of their financial journey. Loan amounts range from $300 to $3,000, with repayment terms spanning 9 to 12 months. Borrowers are categorized into four membership tiers based on their repayment history and prior loan activity: New, Silver, Gold, and Platinum.

Each tier unlocks higher loan limits and more trust-based flexibility.

Tier Breakdown & Borrower Eligibility

Tier Breakdown & Borrower Eligibility

| Tier | Status Requirement | Loan Limit | Repayment Term | Eligibility Criteria |

|---|---|---|---|---|

| New | First-time borrower | Up to $1,000 | 9 months | No prior loan history |

| Silver | Completed 7 payments and 1 full loan | Up to $1,750 | 9 months | Proven payment consistency |

| Gold | Completed 15 payments & 2 loans | Up to $2,000 | 9 months | Strong repayment track record |

| Platinum | Completed 24 payments & 3 loans | Up to $3,000 | 12 months | Excellent borrower history with eLoanWarehouse |

Key Takeaways:

Key Takeaways:

Loan amounts increase with borrower trust and payment discipline.

Repayment terms are longer at higher tiers (12 months for Platinum).

Designed to reward responsible borrowing behavior and maintain access to emergency funds with better flexibility.

Borrowers progress through tiers automatically by completing payments and closing loans successfully.

This tiered approach ensures borrowers aren’t just accessing payday loans—they’re building a responsible financial profile that grants better terms over time.

Basic Eligibility Criteria

A borrower needs to fulfill basic criteria before requesting any financial aid or loan application. Here’s what you need to know:

Minimum Age Requirement

All potential loan recipients need to be at least 18 years old. Like most traditional lenders, eLoanWarehouse does not offer loans to individuals under the legal adult age.Proof of Steady Income

The funding approval requires you to show consistent income sources. Your steady income serves as proof to lenders that you will handle the loan payments with ease. Experience-related income questions are not a barrier to apply but potential applicants can instead use a reliable guarantor with established financial stability.Active Bank Account

Every applicant must maintain an active bank account. The account will receive funding directly from approval, and it needs asmall balance to enable automatic monthly payments.How to Apply for Payday Loans at eLoanWarehouse

Getting a payday loan from eLoanWarehouse is a straightforward process designed to provide fast financial relief without unnecessary hurdles. Here’s a step-by-step breakdown of how it works:

Step 1: Access the Platform

Visit the eLoanWarehouse official website or download their mobile app. Log in or create an account using your email and a secure password.

Step 2: Fill Out the Application

Once logged in, complete a short online application form. You’ll need to provide:

Income details

Bank account information

Loan amount desired

Preferred repayment term

Step 3: Submit Required Documents

Upload clear copies of the following:

Valid ID or driver’s license

Recent bank statement

Proof of income (like a pay slip or direct deposit record)

Step 4: Final Submission

Click the Submit button. Your application will be reviewed, and you’ll receive an approval or rejection via email. If approved, funds will be deposited into your account by the next business day.

Quick Fund Transfer

Once approved, your funds are usually transferred the same day or next business day, helping you cover urgent expenses without delay.

Key Benefits

No Hidden Charges: Transparent rates based on loan size and term.

Quick Disbursal: Fast approval and deposit.

Flexible Repayment: 9–12 month terms depending on loan tier.

Risks to Be Aware Of

Short repayment window: Requires consistent income for timely payments.

Higher APRs: Compared to traditional loans.

Sovereign status: May limit traditional legal recourse.

Pro Tip: Read eLoanWarehouse reviews and all loan terms before applying to make an informed decision.

Contacting eLoanWarehouse

You can reach out for assistance through the eLoanWarehouse phone number or access their online portal for 24/7 support.

Customer Service Hours: Monday-Friday, 8:00 am to 5:00 pm CST.

eLoanwarehouse Phone number: 855-650-661

Hotline Number: 866-299-7585

Fax Number: 715-255-442

Email Address: Customers@eLoanWarehouse.com

Mailing Address: eLoanWarehouse: PO Box 1753, Hayward, WI 54843

Live Chat: You can also eLoanWarehouse through Live Chat on their official website. The support team is available via live chat during their customer service hours.

Via Website Support: You can share your queries by filling out the forms available at their official website. When sending your message, you must enter your name, email, and phone number correctly.

Conclusion

Conclusion

eLoanWarehouse payday loans operate on a customer-first approach, prioritizing speed, transparency, and accessibility. Whether you’re facing an unexpected expense or a sudden cash shortfall, eLoanWarehouse delivers reliable, flexible financial support tailored to your unique situation.

With no hidden fees, a high approval rate, and next-day fund disbursement, it’s no wonder that thousands of borrowers each month turn to eLoanWarehouse as their go-to financial lifeline.

Apply today and take the first step toward fast, stress-free financial relief—backed by clear terms and trusted service.

Frequently Asked Questions (FAQs)

1. What is eLoanWarehouse, and how does it work?

eLoanWarehouse is a licensed tribal lending service operated by Lac Courte Oreilles Services. It provides fast and secure payday loans to help individuals manage unexpected financial emergencies with ease and reliability.

2. How do I apply for a payday loan through eLoanWarehouse?

To apply, visit the official eLoanWarehouse website or download their mobile app. After creating an account, fill out the application form by providing your income details, bank account information, and uploading required documents like a valid ID and recent bank statements. Once submitted and approved, your funds will typically be deposited by the next business day.

3. What are the eligibility criteria for an eLoanWarehouse payday loan?

To be eligible for a payday loan, applicants must:

Be at least 18 years old

Have a valid U.S. bank account

Show proof of consistent income

Reside in the U.S., excluding New York, Pennsylvania, Virginia, and Connecticut

Not be affiliated with the military or have a bankruptcy history

4. What are the repayment terms and interest rates?

Repayment periods range from 9 to 12 months, based on your membership status (New, Silver, Gold, or Platinum). While interest rates may be higher than those at traditional banks, they remain lower than many other payday lenders. All terms, including fees and APR, are disclosed upfront to ensure transparency.

5. Are there any upfront fees or penalties for early repayment?

No. eLoanWarehouse does not charge any upfront fees or penalties for repaying your loan early. You can settle your loan ahead of schedule without incurring any extra costs.

6. Is eLoanWarehouse a legitimate lender?

Yes, eLoanWarehouse is a legitimate finance provider, offering payday loans from $300 up to $3,000, along with structured and flexible repayment options.

7. When will I receive my loan funds after approval?

Once your loan is approved, funds are typically deposited into your account within one hour, making it an ideal solution for urgent cash needs.

8. What should I do if I have trouble making a payment?

If you’re experiencing difficulties with your loan repayment, you can contact eLoanWarehouse’ s customer support at any time. Their team is available 24/7 to assist and guide you through your options.

9. What is the maximum loan amount available?

Eligible borrowers can receive up to $3,000 through eLoanWarehouse’ s payday loan program, depending on their account level and financial profile.